1. General

2. Agents

3. Reimbursements

4. Workday Spend Categories

International tax, services conducted by non US citizens, and foreign payments are highly regulated and complex. It is important to plan ahead and gather all the facts and documentation prior to an event occurring or payment being made. It is a very uncomfortable situation for everyone involved to promise a payment only to find out, after the fact, that there are rules and regulations that prevent an individual from conducting services, and thereby accepting payment.

This is a very good website to provide to the individual you are working with if they are not familiar with U.S. immigration procedures and tax requirements.

When it comes to a non US individual providing services to the University we need to determine 2 things: 1) Can they provide the service (immigration status – determined with the Workday requisition/verification form) and 2) Should there be tax withholding (30% default withholding unless an exception applies – determined with Sprintax).

Generally you should ask yourself the following questions that are common in most situations: Who? What? Where?

- Who are they? This is determined during supplier setup and where you will find out if they are a US Citizen or not.

- What is the payment for? Are you simply purchasing tangible goods from a Non US company? Are you contracting with an individual or agent to provide services? Are you paying for intellectual property or a royalty? Are you paying a prize or award? This will determine not only if payment can be made but what Workday spend category should be charged (See Section 4)

- Where is the event taking place? Is the company in another country? Is the service being performed outside of the US or in the US? Complicated tax rules generally only apply if the service is performed in the United States or intellectual property is purchased from a foreign entity. However, the University is still held to obtaining documentation supporting that position. In the past this was the “Affadavit for Location of Services Performed”. However, we have incorporated this into the Workday requisition process.

Depending on the answers to the above questions will depend on the next steps. Attached is a helpful resource with additional explanations, flowcharts etc.

We have attempted to use Workday to simplify the process. Notable changes include:

- Supplier Setup no longer requires the approval of International Compensation and Taxation (Christine Rodrigue). International suppliers are set up with a default 30% tax withholding and the analysis is done at the requisition level. An applicable form W9 or W8 is required at the time of setup.

- A Workday Requisition is required for most payments to non US Individuals. This tool allows for the pre-approval of the event to ensure that the individual does not violate their immigration status by providing unauthorized services. The requisition presents a questionnaire that provides the information for immigration and tax determination. We have developed this verification form that should be provided to the foreign individual and returned to the Administrative Assistant before services are performed in order to gather the information to complete the requisition. It should be attached to the requisition.

Any payment to a non US citizen or entity is always subject to 30% tax withholding unless an exception can be documented. Examples of some exceptions are:

Individual can take advantage of a treaty.

Event took place outside of the United States.

Individual has been in the United States for a period of time such that they can be considered a “resident for tax purposes”

The University utilizes Sprintax to determine if the individual is eligible for an exception to the 30% withholding.

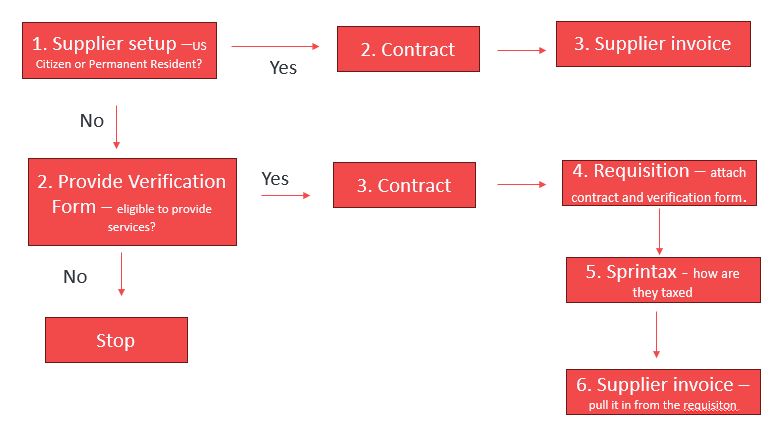

The following is a simplified flowchart of the process related to individual speakers. See the appendix of the training document for additional flowcharts on payments to agents and payments of royalties:

Many non US citizens that are contracted to do a service in the US will go through an agent and direct the payment to be made to the agent. A common misconception is that, by directing this payment to be made to an agent, the payment is therefore not subject to the 30% tax withholding. The IRS rules require that the tax be based on the “beneficial owner” of the income. It is the performer that is the beneficial owner and thus the status of the performer is what determines potential tax withholding, even if the agent is US entity. The individual who is providing the services or “beneficial owner” must always complete the form.

It is logical to think that simply reimbursing a non US individual for their expenses incurred would not be subject to the 30% tax withholding. However, there is one important question to ask – who is benefiting from the activity? If the person is a foreign visitor coming to the U.S. to attend a workshop that we are holding on campus then that reimbursement could potentially be subject to withholding as they could be attending for their own benefit. If it is a reimbursement for an activity for which Wesleyan benefits them it may not be subject to withholding, depending on visa status. That is why we need to collect information on the type of activity.

Workday spend categories are the equivalent of the old WFS account codes. However, Workday adds significant functionality behind spend categories and provides a lot more room for additional descriptions. Therefore, the areas of stipends and honorariums have been greatly expanded to provide additional information for both the preparer and the approver.

The WFS account code “Honorarium” has been broken out into various Speaker and Performer fee spend categories that help determine the location and amount. This not only helps with international tax but also Connecticut’s Athletes and Entertainers tax.

The WFS account code “Stipend” has been broken out to describe who is being paid.

You can choose the appropriate spend category by typing either speaker, performer or stipend in the spend category box. Additional descriptions as to the appropriate use can be found by clicking on the related actions (three dots) next to the spend category.